Start Investing with Insights from Maharaja.

An advisory that supports your Indian market goals. Let Maharaja help you stay on the right track as you begin your investing journey with research-backed insights.

People Joined Us

01

CREATE ACCOUNT

Register with your basic details and get instant access to our Indian stock market advisory dashboard.

02

CREATE ACCOUNT

Our market experts analyse your risk profile and guide you with research-backed trade ideas.

03

CREATE ACCOUNT

Receive timely calls in equities, derivatives, commodities, and indices with disciplined risk management.

Your Best Advisor

Navigate the Indian markets with expert-driven insights and data-backed strategies. We help traders and investors identify high-probability opportunities across NSE & BSE using technical analysis, fundamental research, and real-time market monitoring.

Our advisory approach is designed for beginners as well as experienced market participants — simple to follow, transparent in execution, and focused on consistency rather than speculation.

Trade Smart, Trade Safe.

Make informed decisions in the Indian stock market with expert-backed advisory insights.

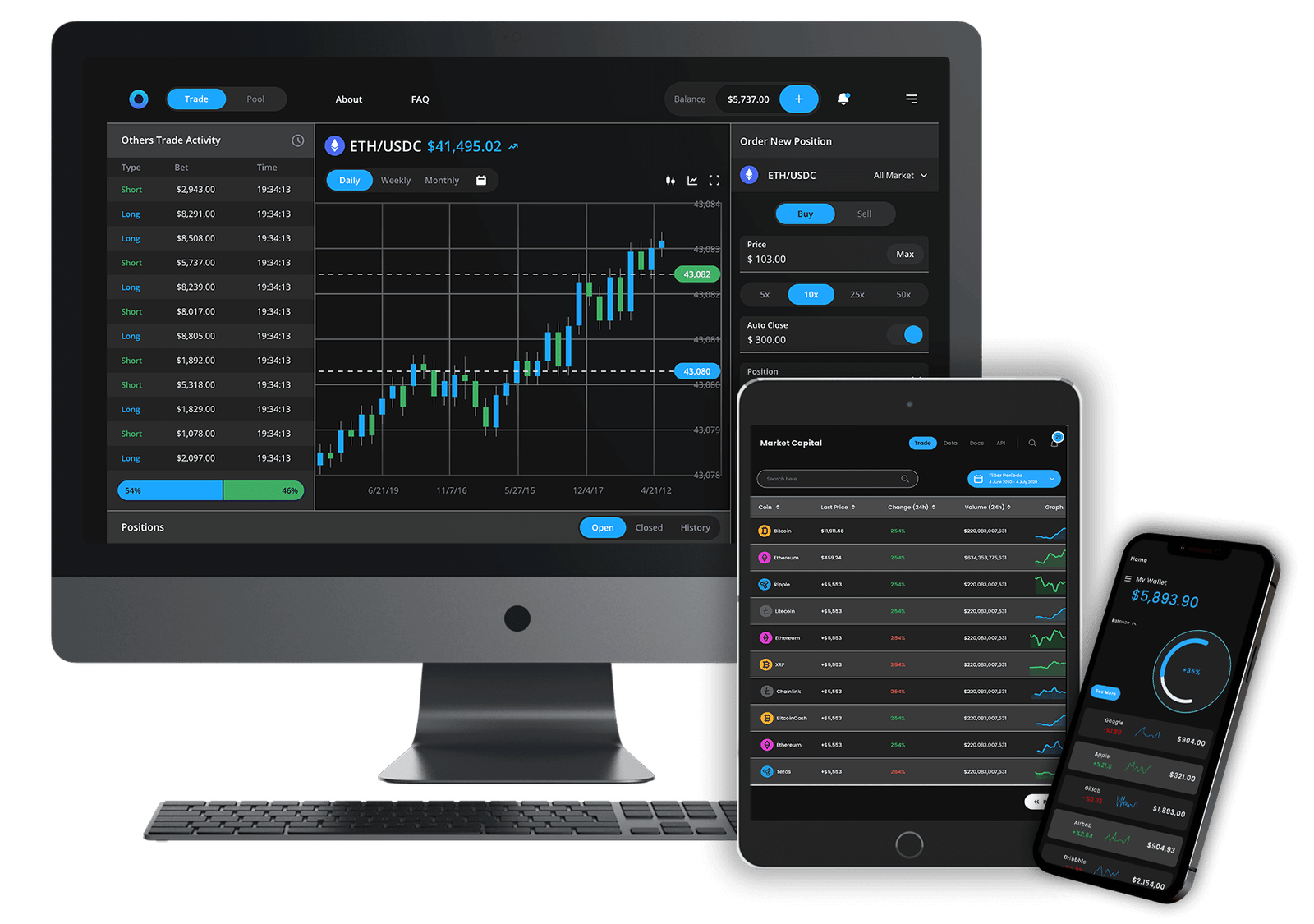

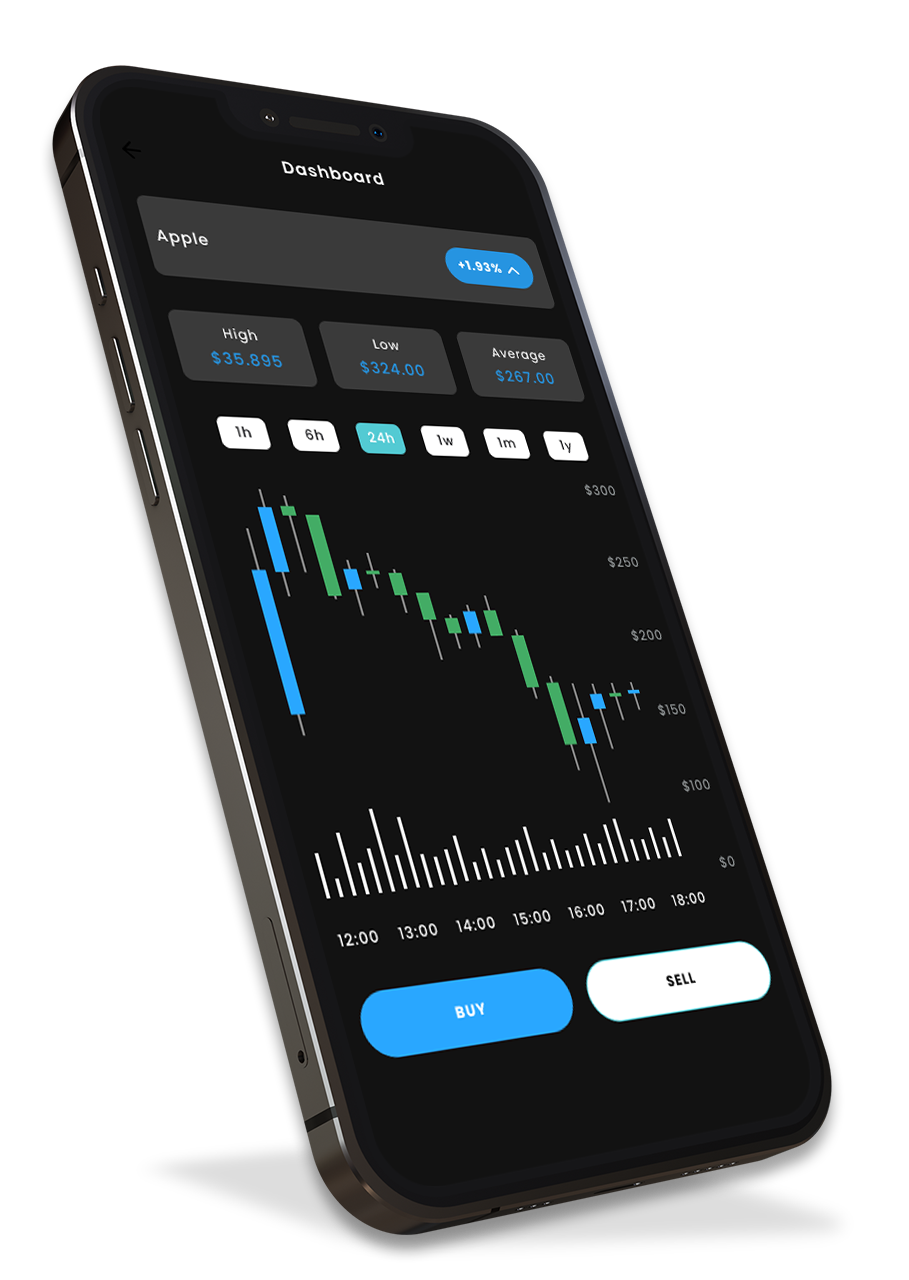

FLEXIBILITY DEVICE

BTC/USD

120.32 |+14% in 16 min

NSE / BSE Markets

Track live movements in equities, indices, and derivatives with real-time analysis and structured trade levels designed for Indian market conditions.

SAFE AND SECURE

Our advisory framework follows disciplined risk management and data-driven analysis to ensure clarity, transparency, and consistency in every market call.

INSTANT EXCHANGE

Get timely trade ideas and market alerts so you can act quickly during high-volatility sessions in Indian equities and derivatives.

24/7 Support

Trade with confidence anytime using clear entry, target, and risk levels shared through simple and easy-to-follow advisory formats on mobile and web.

EXPERIENCED ADVISORS

Our research team studies technical indicators, market trends, and sector strength to provide actionable insights suited to your trading experience.

Smart Investor’s Choice

Discover a smarter way to participate in the Indian stock market with research-driven advisory services designed for modern traders and investors. Access our insights seamlessly through desktop and mobile — simple to follow, reliable, and market-focused.

- Trusted by Indian Market Participants

- Research-Backed Advisory Approach

- Professional Support Team

- Comprehensive Market Analysis

- Optimised Trading Strategies

- Advanced Trading Methodology

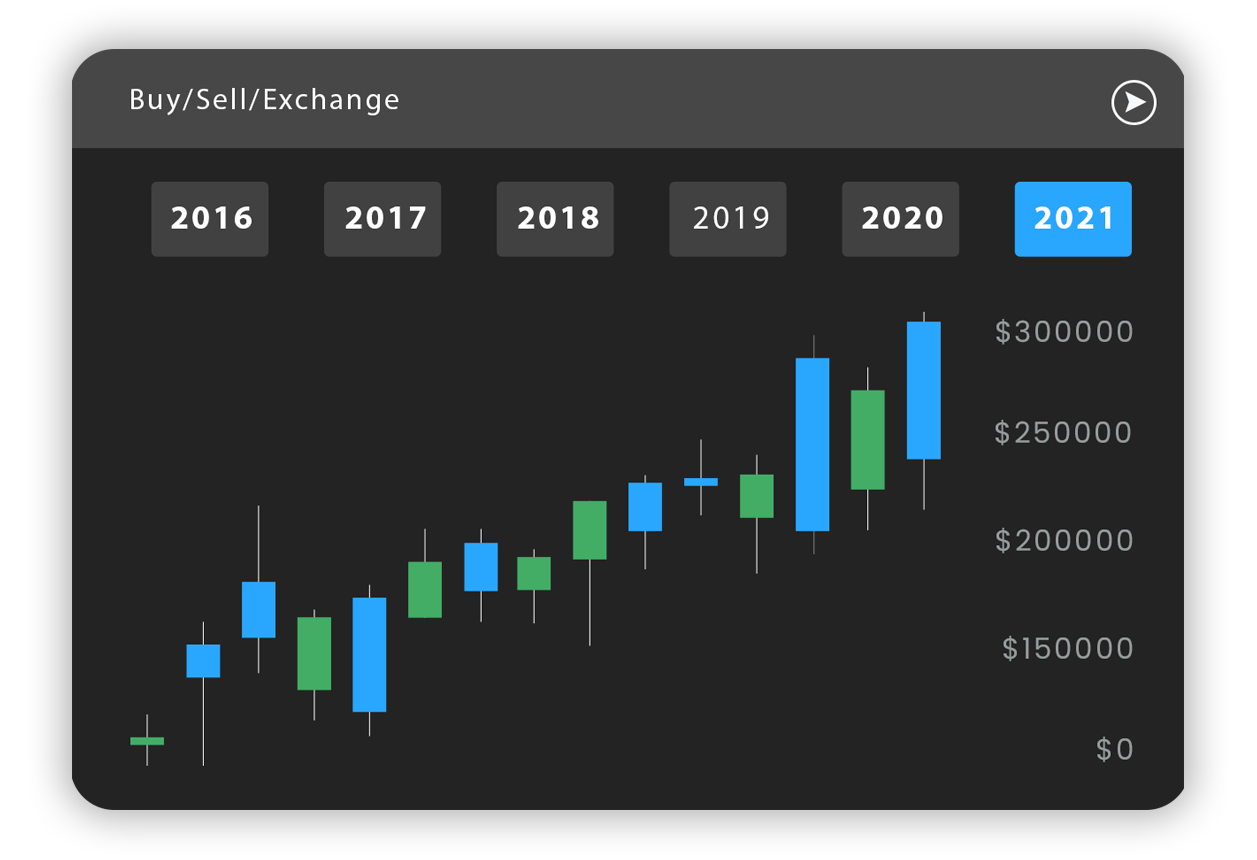

Trade our Product.

Search our Instruments, Check what interest you today.

FOREX

Exchange:

EUR/USD, USD/JPY, GPB/USD, ETC

CRYPTO

Exchange:

BTC/USD, LTC/USD, ETH/USD, ETC

ENERGIES

Exchange:

OIL, GAS, AND ALL ENERGIES

STOCK

Exchange:

APPLE, GOOGLE, FACEBOOK

INDICIES

Exchange:

U$500, UK100, EUR750

METALS

Exchange:

GOLD,SILVER, AND MORE

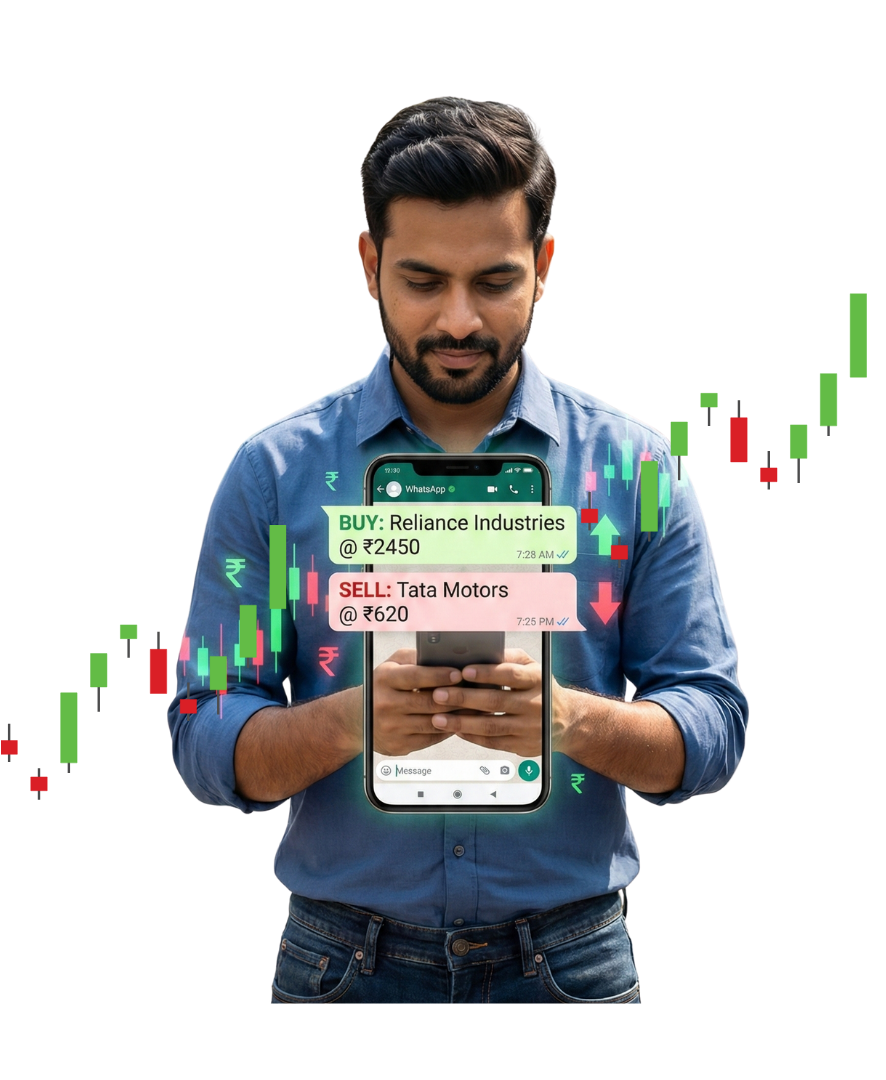

Stay Connected to the Markets.

Keep track of Indian stock market movements wherever you are. Our advisory updates are designed to reach you seamlessly during live market hours, helping you stay aligned with changing trends, momentum shifts, and trading opportunities.

Whether markets are volatile or range-bound, our system ensures you never miss important levels, market views, or actionable insights. From morning market outlooks to intraday updates, everything is structured to support informed decision-making for Indian equity and derivative traders.

4.8

Rakesh Jain

Full-time Trader, India

4.8

By 10K user and traders

for succes trading company

Clear levels, timely updates, and no unnecessary hype. This advisory suits traders who want consistency in Indian markets.

Saurabh Patel

Equity & Index Trader

Indian Markets. Real Traders. Real Insights.

Our advisory ecosystem is built around the realities of Indian stock markets. From index movements to stock-specific setups, we focus on clarity, structure, and disciplined execution rather than speculation.

Traders receive research-backed insights that align with live market behaviour, helping them navigate uncertainty with confidence and a defined approach to risk and reward.

Every market view is designed to support informed decisions — whether the market is trending, consolidating, or volatile.

Trading focuses on short-term market movements where positions may be held for minutes, days, or weeks, depending on the strategy. Investing is a long-term approach that aims to build wealth over time by holding fundamentally strong companies through market cycles. Both require different mindsets, risk management, and time involvement.

In the Indian market, participants typically engage in equity shares, index derivatives (like Nifty and Bank Nifty), stock futures and options, and commodities. Each asset class behaves differently and suits different risk profiles and time horizons.

There is no fixed minimum amount. Investing can begin with small capital through equities or systematic approaches, while trading capital depends on the segment, strategy, and risk management rules followed. It is always advisable to start with an amount you can manage comfortably.

Market movements are influenced by multiple factors such as economic data, global cues, and investor sentiment. Trading carries higher short-term risk due to volatility, while investing involves market cycles and business-related risks. Proper risk management, discipline, and realistic expectations are essential in both approaches.

Let's keep in touch.

Submit relevant information for live consultation with top product Trading.

Email Address

hello@maharaja-enterprises.in

Dharmender

Address

Shop no. 3, anta road, Sure coaching, 176 Prashant vihar, Chak Harati, Saharanpur, Uttar Pradesh, 2470, 01